Your all-in-one client platform for just $5/month.

Join more than 20,000 accountants, bookkeepers, and clients using Uncat to clean up uncategorized transactions with Uncat Transactions, collect and process any receipt with Uncat Receipts, and request specific docs, ask questions, and more with Uncat Requests.

Free 7-day trial. No credit card required.

Uncat integrates with QuickBooks Online, QuickBooks Desktop, and Xero. Or use it without connecting any books.

Save time and delight your clients with Uncat

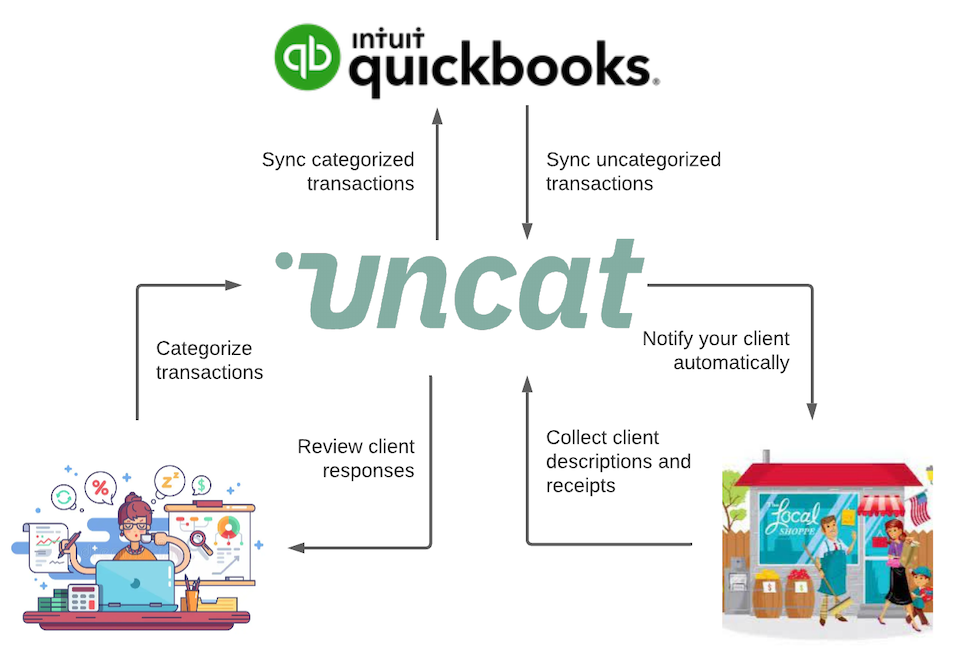

How Uncat Transactions Works

No spreadsheets. No chasing clients. $2,972,437,743 in uncats processed since 2019.

Why accountants and bookkeepers love Uncat 😻

Book a live demo to see Uncat in action

Please choose a convenient time below or reach out to us at hello@uncat.com with any questions.

Getting started with Uncat is as easy as…

Start a free 7-day trial.

Connect a client file (you’ll be able to choose from QuickBooks Online, QuickBooks Desktop, Xero, or without any books connected).

Choose which accounts to sync and how far back to sync, and then enter the client’s email address so we can invite them to Uncat on your behalf. The email invitation will contain a Magic Link to take your client straight to their Uncat dashboard.

At just $5/month/client, Uncat is the cat’s meow 😺

Here’s what you can do with Uncat:

Integrate with QuickBooks Online, QuickBooks Desktop, and Xero.

You can have clients from multiple accounting platforms all on one Uncat dashboard. View up to 10 clients per page in your Uncat Dashboard so you don’t have to open a separate browser tab for each client at month-end close.

Choose which accounts you want to sync for each client.

For example, you could sync Uncategorized Expense, Uncategorized Income, Uncategorized Asset, Ask My Accountant, Ask Client, Suspense, etc.). Transactions will sync into Uncat automatically going forward. You can also choose to optionally sync all transactions missing a certain field even if they’ve already been properly categorized. For example, you could choose to sync all transactions missing a Class or an Attachment or a Vendor.

Select a date for how far back you want to sync.

Uncat syncs back 3 months by default. You can sync back further for a one-time charge of $5 per additional month which is great for cleanups. There is no limit on the number of transactions you can sync

Notify client users automatically each week.

Uncat will send notifications by email and optionally by SMS text message when there are transactions that need a client response (weekly or daily or monthly). Notifications contain a Magic Link so that client users have 1-click access to their Uncat Dashboard. Client users don’t need to set up an account, create a password, download an app (clients can update Uncat via their mobile web browser), or even have a login to QuickBooks or Xero. You can invite unlimited client users at no additional cost. Plus, no more spreadsheets!

Ask clients to provide Descriptions and optionally Attachments for transactions.

You can also ask (or require) that client users provide additional information like Vendor, Customer, Class, Location, Billable, Tax, and Account (aka Category). Optionally assign client users to update transactions from specific accounts (e.g. John should see uncategorized expenses from AMEX-1234. Susan should see deposits in Uncategorized Income.) Client updates (Descriptions, Attachments, etc.) sync into QuickBooks or Xero.

Request W9s, 1099s, bank statements, etc. from your clients.

Ask clients for key information and important documents via the Requests tab in the Uncat Dashboard.

Invite your colleagues to join your Uncat account.

You can invite unlimited accountant users at no additional cost. Optionally assign accountant users to specific clients. Set a permission level for each account user (Firm Admin: Everything including billing and user assignments; Client Admin: Add clients and update client settings and categorize transactions; Team Member: Categorize and update transactions in the Uncat Dashboard.)

Categorize transactions and update other fields and sync to QuickBooks or Xero.

You can update Category, Vendor, Customer, Class, Location, Billable, and Tax in your Uncat Dashboard and click Save to sync right away into QuickBooks or Xero. You can also bulk update transactions (e.g. You could assign the same Class to multiple transactions.). You can also split individual transactions by category or by class.

Apply bulk actions to transactions.

For example, you can assign the same Class to a list of transactions in the Uncat Dashboard in a few clicks.

Send and receive messages with any client.

Communicate with your clients via Client Chat and with your internal colleagues via Company Chat.

Add your custom branding to Uncat.

Upload your logo and choose a theme color to match your brand. There is no additional charge for white-labeling.

See analytics by client and for your firm overall.

You can see the number of transactions, value of transactions, most common vendors and customers, and more for your firm and for each client.

Enjoy peace of mind.

We use SSL and multiple levels of security that have passed the QuickBooks App Store and Xero Marketplace security reviews.

Contact customer support anytime.

Support is available via in-app chat, email, and support ticket.

Pay just $5 per month per client file you connect to Uncat.

You choose which clients to connect. By properly categorizing transactions with your clients, you’ll generate more accurate financial reports, trigger fewer audits, and file more accurate taxes. And with better client communications, you’ll see higher client retention and more growth in your practice.

Accounting tech expert Jason Staats reviews Uncat

Test your knowledge in the Uncat quiz

Did you know the average business has $10,000 in uncategorized transactions every month?

Meet the team behind Uncat

A few accounting jokes to make you smile 😃